You can better understand your situation and react appropriately.

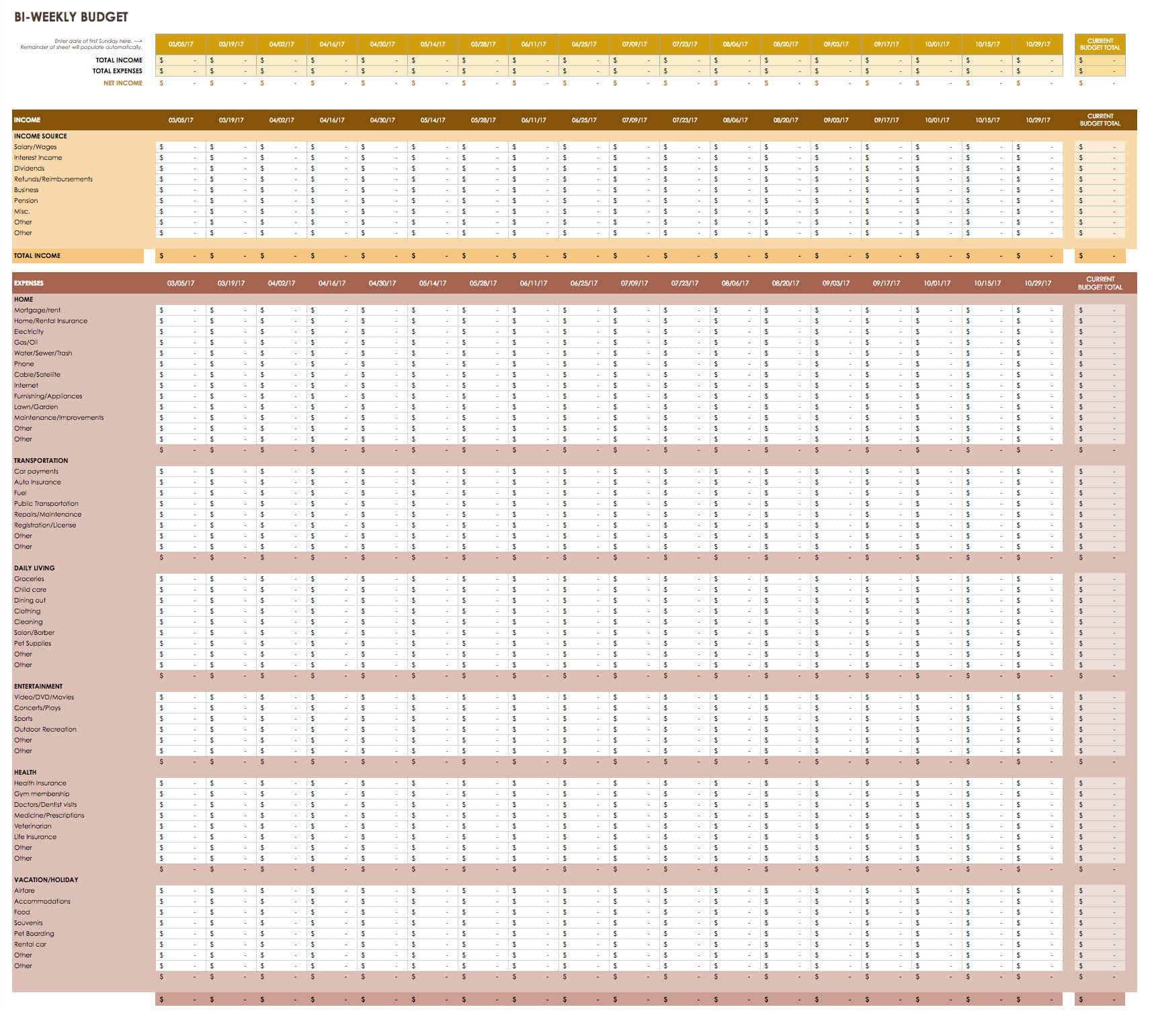

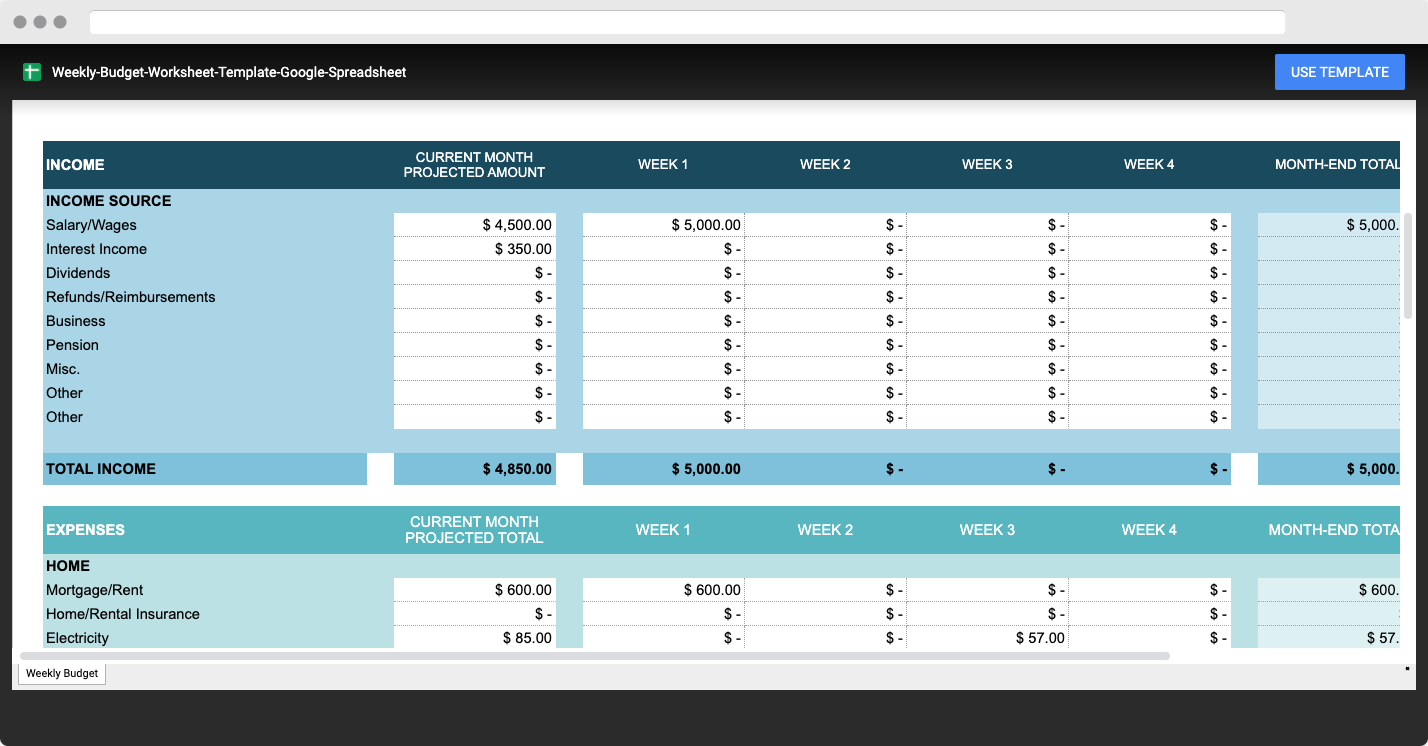

If you control your budget, you will know how to manage your costs effectively and you will know when you need to increase investments, ensuring reliable financial analysis.Īnother advantage of the budget worksheet is that it gives you more agility in financial analysis and answers to potential problems that may arise. With a comparison of these expenses, set a goal and try to achieve it this spreadsheet will highlight the losses over a given period and you can take the necessary steps to correct or propose alternatives that will not affect productivity.Ĭontrol is the main reason for establishing a spreadsheet. Then you should describe each expenditure in the selected period (labour, electricity, water, fuel, etc.). It is then essential to divide your sheet into periods, months or weeks so that you can make future comparisons on the increase or decrease of your expenses and revenues. You can organize your data quickly and easily. There are two simple ways to develop a spreadsheet with Excel or Google Sheets (located on Google Drive).

In today’s article, we give you some tips on budget worksheets and how to develop them for your company.

With a well-structured budget spreadsheet, you will find everything a manager is looking for : control over your procedures and a clear view of unnecessary expenses. For SMEs with revenues of up to $15 million per year, the spreadsheet is even more crucial given the number of competitors, the ongoing need to reduce costs to improve cash flow and the need to have alternatives available when you need to make strategic decisions. Buget Spreadsheet – Nowadays, no company can dispense with activity reports and budget worksheets, the latter being particularly important because they are directly involved in your company’s expenses.

0 kommentar(er)

0 kommentar(er)